Liquidium.WTF API: Bitcoin-Native Instant Loans for Ordinals and Runes

Jan 7, 2026

Liquidium.WTF API: Bitcoin-Native Instant Loans for Ordinals and Runes

Instant Loans on Liquidium.WTF made it possible to borrow Bitcoin against Ordinals and Runes in a non-custodial, PSBT-based flow way.

Liquidium.WTF APIs bring Instant Loans to your product. It enables wallets, marketplaces, and financial applications to integrate Bitcoin-native borrowing, repayment, and Buy Now, Pay Later (BNPL) flows directly into their app

What Is The Liquidium.WTF API?

Liquidium.WTF’s Instant Loan API is a transaction-ready API suite designed to integrate Bitcoin-native finance directly into applications.

Liquidium.WTF API enables real loan execution on Bitcoin, using:

Wallet-based authentication via Bitcoin message signing

Ordinals and Runes as first-class collateral

PSBT (Partially Signed Bitcoin Transaction)-based transaction flows for borrowing and repayment

The API abstracts away complex Bitcoin transaction construction while preserving full user custody and on-chain settlement.

What Can Liquidium.WTF API Do?

Liquidium.WTF API supports the complete lifecycle of an instant Bitcoin loan, from authentication to repayment.

Wallet-Based Authentication

Users authenticate by signing a unique message with their Bitcoin wallet.

Once verified, the API returns an authentication token used for subsequent requests.

This approach is:

Non-custodial

Wallet-native

Ideal for Bitcoin wallets and Web3 applications

Discover Available Collateral (Ordinals & Runes)

The API provides endpoints to retrieve all supported collateral assets, including:

Ordinal collections with floor prices and loan terms

Rune tokens with decimal precision, supported ranges, and pricing

Optional counts of active loans and available offers

This enables applications to display:

Borrowable assets

Estimated loan values

Market-level lending activity

Retrieve Real-Time Loan Offers

For a selected Ordinal collection or Rune amount, the API returns available instant loan offers, including:

Loan principal and duration

Interest calculations

Activation fees

Discount information for Liquidium token holders

Offers are filtered to exclude the user’s own positions and return the best available terms.

Start a Loan Using PSBT

Borrowing is handled through a secure two-step process:

Prepare Instant Loan Transaction

The API validates parameters and returns a PSBT containing the loan transaction.Submit Signed Loan Transaction

The user signs the PSBT with their wallet, submits it, and the API broadcasts the transaction to the Bitcoin network.

Once confirmed:

The collateral (Ordinal, Rune) is secured

The loan is activated

Funds become available for the borrower

Repay Loans and Release Collateral

Repayment follows the same PSBT-based pattern:

Prepare a repayment transaction including principal, interest, and fees

Submit the signed PSBT to broadcast and finalize repayment

After completion, the loan is closed and the collateral is released back to the borrower.

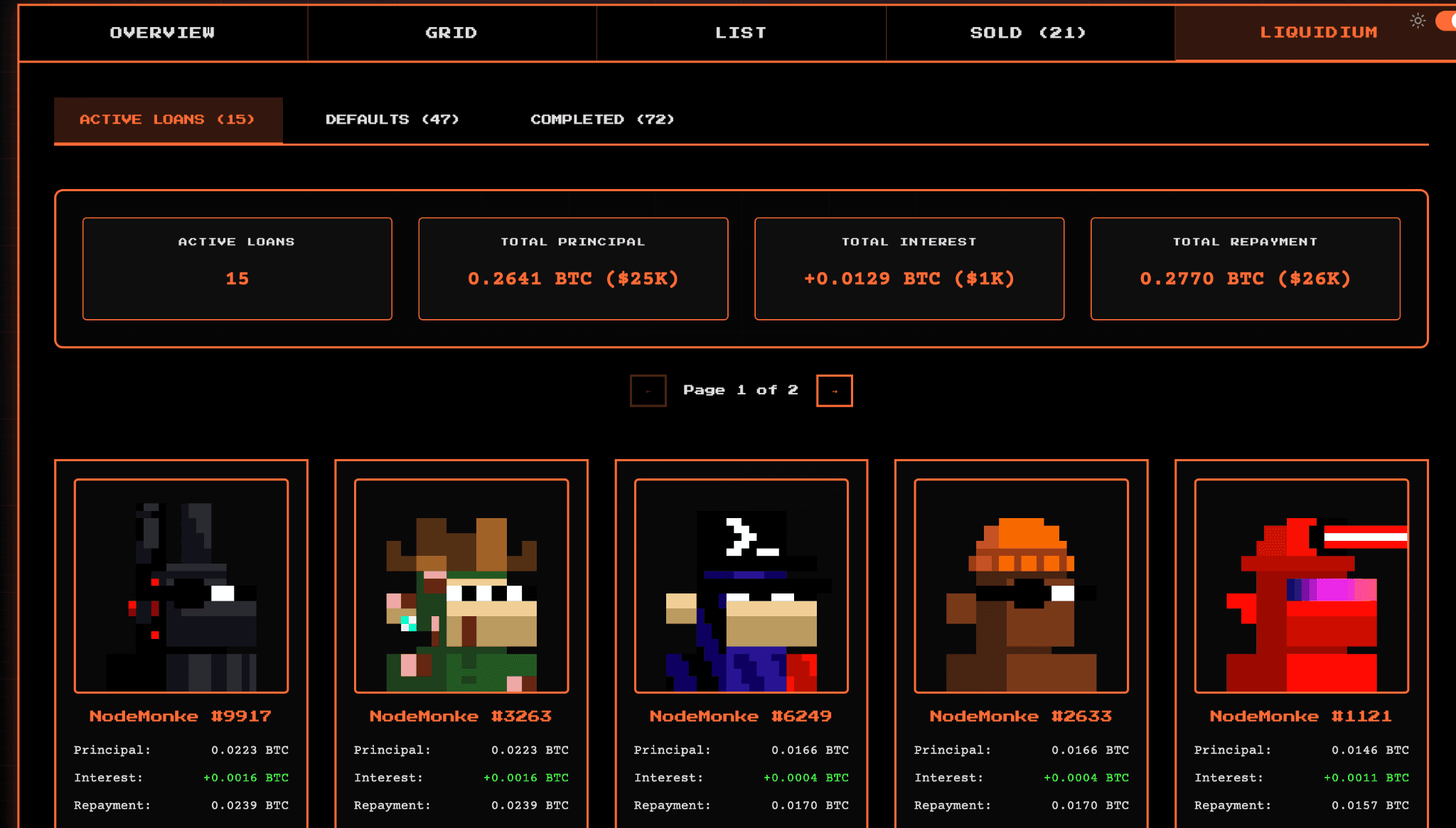

Portfolio and Balances

Liquidium.WTF API also supports portfolio-level visibility of lending and borrowing positions for individual accounts.

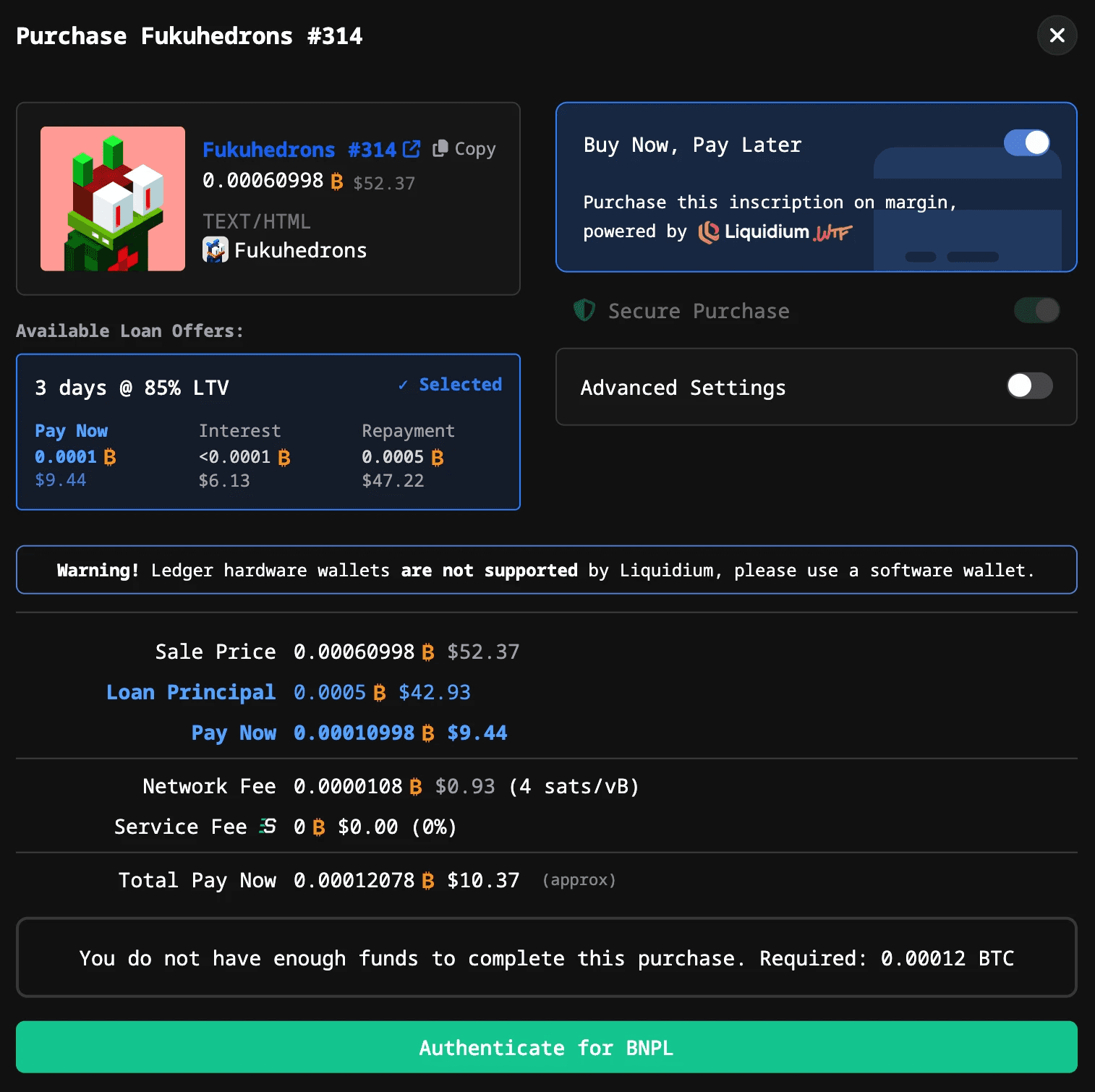

Buy Now, Pay Later (BNPL) for Marketplaces

Liquidium.WTF API supports BNPL flows that integrate instant loans directly into marketplace purchases.

All transactions are finalized atomically on Bitcoin, allowing users to purchase assets immediately while borrowing against them.

You can find more information about BNPL here.

Who Can Use Liquidium.WTF API?

Bitcoin-native Wallets

Add instant borrowing features

Enable wallet-based authentication

Display loan eligibility and portfolio data

Ordinals & Runes Marketplaces

Offer BNPL at checkout

Increase conversion rates and transaction size via the BNPL feature

One example of BNPL adoption is Liquidium.WTF’s integration with Satflow, which enables instant purchasing power for Ordinals without requiring buyers to pay the full price upfront. At checkout, buyers can finance part of the purchase using an instant loan, while sellers receive full payment immediately

The Ordinal is secured in escrow, and the loan terms—principal, interest, and duration—are enforced on-chain without custody risk.

For marketplaces, BNPL via Liquidium.WTF’s API increases conversion rates and transaction size by reducing upfront capital requirements for buyers. For users, it unlocks access to high-value Ordinals while keeping assets on Bitcoin and loans fully non-custodial.

Digital Asset Treasuries (DATs)

Monitor lending and borrowing positions at the portfolio level

Track Bitcoin balances

Improve treasury management and capital allocation decisions

Liquidium.WTF has partnered with NodeStrategy, the first Digital Asset Treasury (DAT) on Bitcoin L1. Using the Liquidium.WTF’s API, NodeStrategy displays real-time treasury management data on its website, including key metrics such as principal, interest, and repayment status.

Get Started with Liquidium.WTF API

Liquidium.WTF has published the official Liquidium.WTF API documentation, covering authentication, instant loans, and transaction flows.

Find more information via the help article or dive directly into the API documentation.

FAQ

Do I need to manage Bitcoin transactions manually?

No. The API prepares PSBTs and validates parameters, while users sign transactions with their wallets.

What assets are supported as collateral?

Currently, supported ordinal collections that are classified as Instant Loan eligible and all Rune tokens.

Is the Liquidium.WTF API suitable for production applications?

Yes. The API is designed for real transaction execution, not just data access.