How To Buy Now Pay Later for Ordinals

Dec 1, 2025

Liquidity has long been a challenge in the Ordinals ecosystem — but new financial tools are emerging to make it easier than ever for collectors to participate and thrive. One such tool is Buy Now Pay Later (BNPL) — a way to acquire premium Ordinals without needing to pay the full amount upfront.

Through a new integration with marketplaces like Satflow, liquidium․wtf enables BNPL functionality for Ordinals via their APIs, by letting Buyers borrow BTC at the time of purchase.

Let’s walk through how it works, why it matters, and how you can use it today.

TL;DR: BNPL for Bitcoin Ordinals

Buy Now Pay Later Ordinals lets collectors acquire Ordinals (Bitcoin NFTs) instantly while paying over time.

Powered by Liquidium.WTF’s native API’s and integrated with Ordinals marketplaces like Satflow.

If the Buyer defaults, the Lender will be able to unlock the Ordinals.

Regardless of whether the buyer repays the loan, the seller receives full payment at the time of purchase.

The Buyer pays interest like any other Borrower on Liquidium.WTF.

What Is Buy Now Pay Later for Ordinals?

BNPL for Ordinals allows a Buyer to secure ownership of Ordinals while paying for it later — using a loan from a BTC Lender on Liquidium.WTF.

This is especially useful if collectors want to grab an Ordinal immediately, rather than waiting to accumulate more BTC, With this function, for example, collectors can avoid being sniped when bidding on a rare collection.

BNPL turns collecting into a flexible financial decision, not just a spending decision.

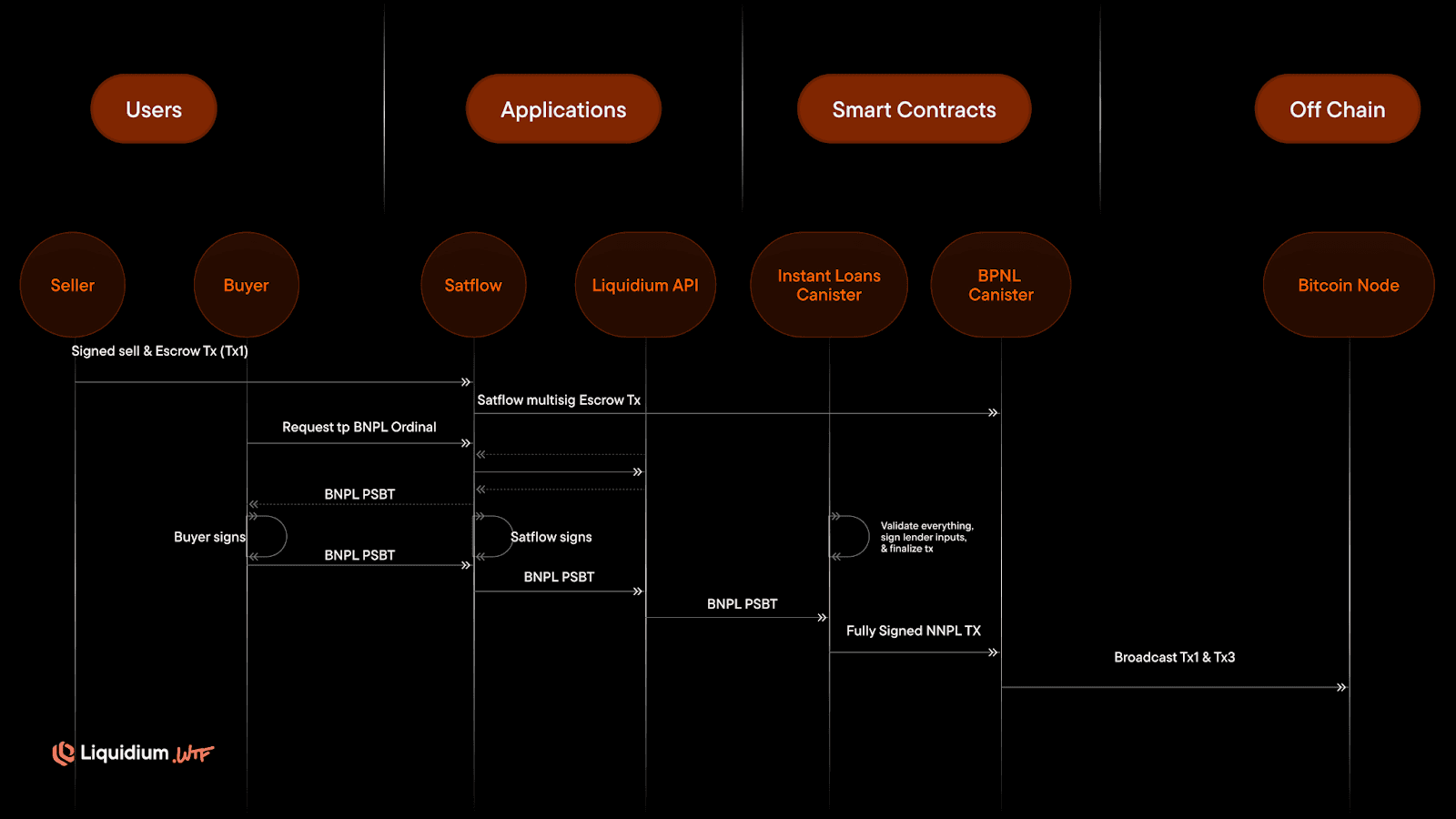

How Does It Work Technically?

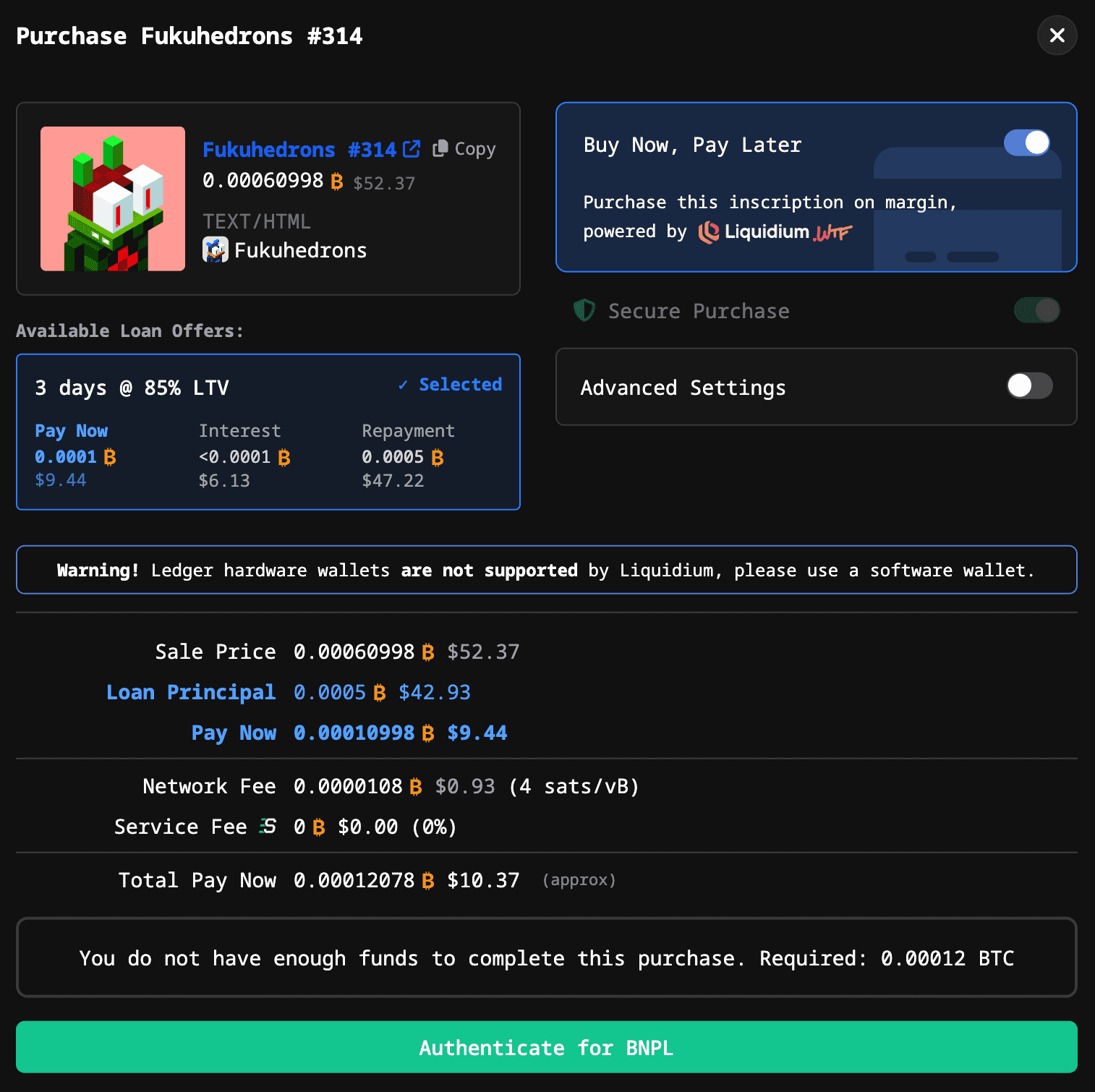

BNPL for Ordinals uses Liquidium.WTF’s P2P lending system and PSBT (Partially Signed Bitcoin Transactions) architecture. Here's a step-by-step breakdown of the current integration with Satflow:

Buyer prepares UTXOs (if needed) for partial BTC payment.

Seller signs Tx1 and Tx2.

• Tx1 — the original listing on Satflow

• Tx2 — the actual sale of the asset

Buyer initiates the purchase, requesting to pay via BNPL.

The full PSBT for Tx2 is constructed, combining inputs, outputs, and logic for Ordinals + loan.

Buyer signs Tx2 with ALL — they agree to the terms (for example: 30% purchase from buyer’s BTC & 70% utilizes a Liquidium loan).

Liquidium․wtf BNPL canister signs with ALL — after validating the transaction, Liquidium.WTF provides the loan.

Satflow signs the 2/2 inscription spend to finalize the Ordinal transfer.

Tx1 and Tx2 are broadcast — finalizing the purchase, with Liquidium.WTF providing the BTC.

At this point, the Ordinal enters escrow, Buyer and Liquidium.WTF's Lender paid the Seller in full, and the Buyer must repay the remaining loan principal before expiration to fully purchase the Ordinal. If the Buyer does not pay back the remaining debt, the Lender will be able to unlock the Ordinal out of the escrow.

What Happens If the Buyer Defaults?

Like all Liquidium.WTF loans, BNPL transactions are trust-minimized and overcollateralized. If the Buyer fails to repay the loan within the agreed term:

The Lender can claim the Ordinal used in the transaction via Satflow or Liquidium.WTF.

The Borrower (also the Buyer) will lose the upfront payment and the Ordinal.

No intermediary is needed.

This creates a win-win structure: the Buyer can lock the Ordinal for a period, the Lender is protected, and the Seller gets paid in full at the start of the loan.

Why Is BNPL Important for the Ordinal Ecosystem?

BNPL brings much-needed flexibility and liquidity to the Ordinals market. It allows:

Collectors to seize opportunities without selling other assets.

Lenders to earn yield backed by high-value Ordinals.

Marketplaces to onboard more users through financial accessibility.

For high-value collections like NodeMonkes or OMB, this unlocks new ways for users to participate in blue-chip Ordinals.

Liquidium.WTF's BNPL API functionality is designed to be integrated with any other Ordinals marketplace using PSBTs compatible logic.

As a fully on-chain, non-custodial protocol, Liquidium.WTF acts as the backend liquidity layer — verifying transactions, providing BTC liquidity, and securing Lenders.

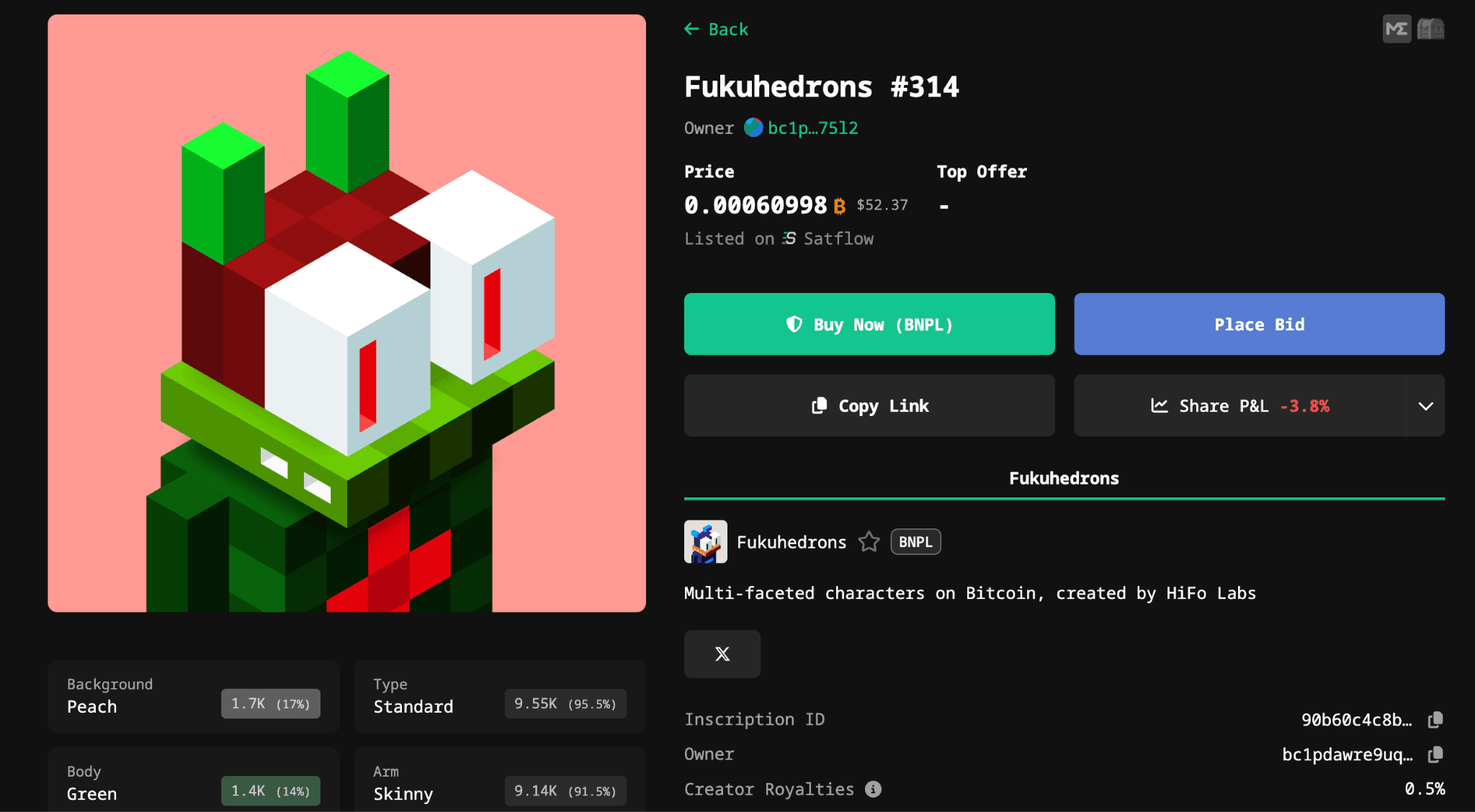

Try BNPL on Satflow with Liquidium.WTF

Whether you’re trying to acquire your first rare Ordinal or flip a mid-tier one before the floor runs up, BNPL powered by Liquidium.WTF gives you more optionality.

Go to Satflow to find a listing. If BNPL is available, you’ll see the option at checkout. Behind the scenes, your BTC loan is handled by Liquidium.WTF.

Connect your wallet, accept the terms, and secure your Ordinal purchase price — while paying later.

FAQ: Buy Now Pay Later for Ordinals

Who pays the interest?

The Buyer. BNPL Buyers are Borrowers on Liquidium.WTF and pay interest like on any other BTC loan.

Can I use BNPL on any marketplace?

Currently only available on Satflow.

What happens if I don’t repay?

The Ordinal is claimed by the Lender via Satflow or Liquidium.WTF.

Are BNPL loans different for Lenders?

No. Whether it is a usual loan or a BNPL loan, the terms, and functionality are the same for Lenders.

How do I know I’m getting the Ordinal?

The transaction is only broadcast once all parties have signed the PSBT, ensuring the Ordinal is transferred atomically with the loan.

What Are the Terms and Duration?

BNPL loans follow the same parameters as standard Liquidium.WTF loans: Loan durations vary by Lender (commonly 7, 14, or 30 days). The Buyer agrees to these terms upfront before receiving the Ordinal.